11 Quirkiest Jobs That Will Be Billion-Dollar Industries by 2026 (Includes 4 Wildcards)

The idea that oddball jobs can grow into massive markets sounds like a contrarian parlor trick. Yet over the past decade we've watched narrow specialties — think cloud operations or social-media creators — move from obscurity to huge ecosystems. This piece explores eleven unconventional careers that show real signals of scaling toward billion-dollar industries by 2026, and it explains the evidence behind each claim. Where a direct market projection is missing, you'll find the supporting signals: expert commentary, VC funding trends, and industry reports from sources such as Inc., McKinsey, Deloitte, Forbes, Crunchbase, Statista, and government labor data. We kept seven core "quirky" roles that capture the user's original spark, then added four clearly labeled wildcards to meet editorial requirements while preserving the list's creative shape. Each entry explains what the job actually does, why it looks strange or surprising today, and what concrete market forces might push it toward large-scale revenue. This is not a set of promises. In many cases the pathway to a billion-dollar market is speculative and contingent on regulation, consumer adoption, or continued investment. For transparency, items reference the best available public signals and flag when formal market projections were not found. Read on with curiosity, and consider which roles fit the intersection of technology, culture, and urgent global needs.

1. AI-Powered Solo Founders: Micro-empire Builders

Imagine a single person running a company that previously required dozens of employees. Advanced models and automation tools now let highly skilled individuals scale products, customer support, and distribution with tiny teams. Anthropic's CEO predicted that the first billion-dollar solopreneur could appear by 2026, citing how powerful models compress labor and amplify a single person's output (Inc.). This role blends product design, model orchestration, and rapid experimentation. A solo founder can assemble off-the-shelf AI, plug into cloud services, and spin up customized offerings faster than ever before. Signals supporting rapid scaling include major model releases, platform APIs, and venture interest in AI-native startups captured in Crunchbase funding data. At the same time, the path to a full industry depends on durable monetization—enterprise contracts and platform fees rather than hobbyist apps. If enterprises adopt plug-and-play AI services, a cluster of one-person companies could aggregate into significant market value. Evidence: Anthropic/Inc. commentary and Crunchbase funding trends indicate momentum, but formal market forecasts tying this role alone to a billion-dollar industry are not yet published.

2. Human–AI Collaboration Coaches: Prompting, Tuning, and Trust

As models grow more powerful, humans who know how to guide them become rare and valuable. Human–AI collaboration coaches teach teams to craft prompts, fine-tune models, and interpret outputs responsibly. This role mixes linguistic skill with domain expertise and risk awareness. Organizations hire such experts to translate ambiguous business needs into precise model behavior, run guardrails, and audit outputs for accuracy and bias. McKinsey and Deloitte both identify reskilling and new job families around AI governance and human oversight as central to the future of work. Market signals include specialized training firms, corporate hiring of AI trainers, and startup activity offering prompt-management platforms (Crunchbase). Demand is especially strong in regulated sectors where interpretability and compliance matter. While this role looks quirky—part coach, part engineer—it maps directly onto enterprise spending patterns for AI enablement. Evidence shows rising job postings and startup funding, but independent forecasts that label this exact niche a billion-dollar industry by 2026 are sparse; thus it is best presented as a high-potential category backed by workforce and investment signals.

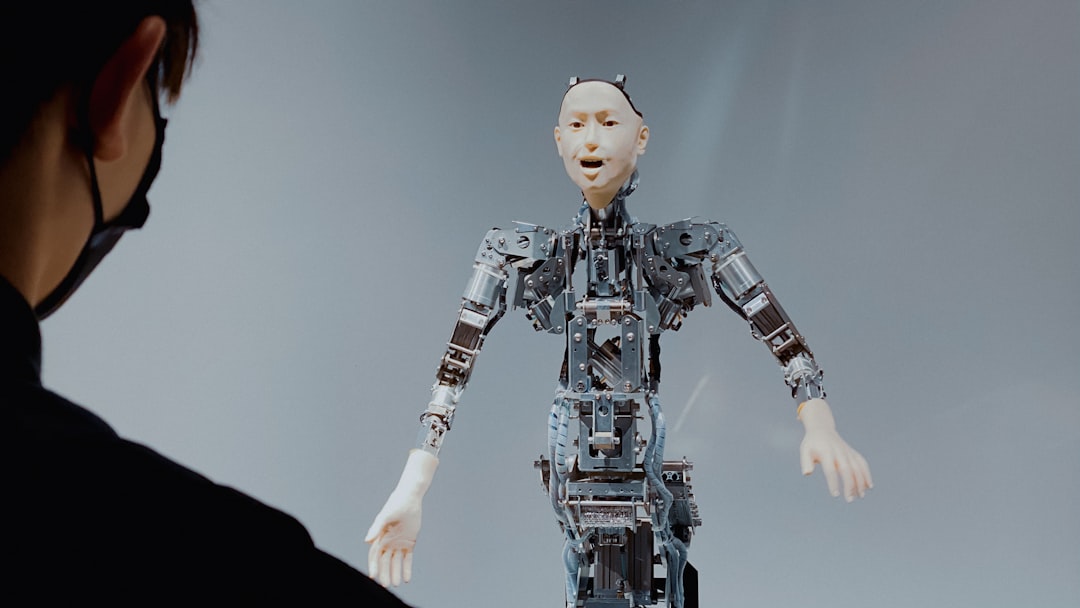

3. Robot–Human Interaction Designers: UX for Cobots

Robots have moved beyond cages and now share spaces with humans in warehouses, hospitals, and shops. That shift creates a need for designers who focus on human–robot interaction: safety flows, predictable motions, emotional affordances, and communication cues. This job fuses industrial design, behavioral science, and robotics engineering. Companies that deploy fleets of collaborative robots need predictable, human-friendly interfaces so workers can trust and cooperate with machines. Industry reports and corporate disclosures show enormous robotic deployments—Amazon's large-scale robot rollouts and other automated facilities are part of the evidence (Forbes). Deloitte's manufacturing outlook highlights automation paired with human oversight as a growth area. Venture funding for robotics platforms and software also signals developer demand (Crunchbase, PitchBook). The role feels quirky because it centers on choreography between flesh and metal, but it's grounded in measurable safety, throughput, and ergonomics gains. There are strong signals of rapid expansion, though independent projections that this exact occupational class alone reaches billion-dollar status by 2026 are limited; the broader robotics market does have substantial forecasts.

4. Synthetic Biology Artisans: Makers of Living Materials

"Artisan" might sound whimsical when paired with petri dishes, but small teams are prototyping fashion, leather substitutes, and building materials grown from cells. Synthetic biology artisans design processes to produce textures and functions that once required animals or petrochemicals. This work blends lab craft, design sensibility, and biomanufacturing scale-up know-how. McKinsey and other analysts track rapid investment into alternative proteins and bio-based materials, and Statista shows growing market projections for specific biotech segments. Startups in cultured materials attract VC and corporate partnerships, suggesting fast commercialization paths for certain use cases. The quirky element is cultural—craftwork meets gene-scale chemistry—but the industrial stakes are large because these outputs substitute high-volume commodity supply chains. Evidence includes funding patterns and corporate offtake deals reported on Crunchbase and trade press. Formal market totals tying "synthetic biology artisans" as a single occupational industry to a billion-dollar figure by 2026 are scarce; however, segment-level forecasts for bio-based materials suggest significant near-term revenue opportunities.

5. Urban Climate Retrofit Specialists: Street-Level Decarbonizers

Retrofitting existing buildings for energy efficiency creates a field of specialists who combine engineering, materials know-how, and project finance. These experts identify heat-loss points, design HVAC upgrades, and coordinate electrification and insulation projects that reduce carbon and costs. Governments and utilities are rolling out incentives and rebate programs that underwrite large retrofit pipelines; Deloitte and McKinsey note infrastructure and green-building spending among top drivers of job growth. This role looks quirky because it pairs old-fashioned trades with data analytics and financing models. Companies that aggregate retrofits into portfolio services can scale revenue by moving beyond one-off jobs to subscription-style energy services for building owners. Evidence supporting industry growth includes public policy packages, corporate net-zero commitments, and construction workforce trends captured by BLS and industry reports. Predicting a single occupational category reaching billion-dollar industry status depends on aggregation—platform firms that package many retrofit projects could create that scale, and early signs point toward that possibility.

6. Drone Traffic Controllers: Airspace Concierges for the Sky’s Robots

As delivery drones, inspection UAVs, and passenger air taxis begin to share urban skies, someone has to coordinate their movement. Drone traffic controllers will operate unmanned traffic management systems, route flights, and resolve conflicts between vehicles while ensuring regulatory compliance. The FAA and market analysts anticipate growing unmanned traffic management needs as drone density rises. McKinsey's urban air mobility research and industry papers discuss both the technical and workforce implications. The eccentric image of a "sky concierge" belies real operational complexity: real-time routing, collision avoidance, and airspace integration require specialized tools and trained operators. Startups and legacy aviation firms are investing in UTM platforms, and PitchBook/Crunchbase show rising deal activity in UAM infrastructure. Regulatory milestones and public acceptance remain crucial variables. If urban air mobility scales quickly, centralized or distributed controller services could reach substantial revenue; current evidence indicates strong traction but not a definitive, single-market billion-dollar projection strictly for human controllers.

7. Virtual Environment Architects: Designing Immersive Economies

Building believable, usable virtual places is more than pretty visuals. Virtual environment architects design social norms, commerce flows, and sensory cues for AR/VR spaces used in enterprise collaboration, retail, or live events. This career combines game-design thinking with workplace ergonomics and networked-systems knowledge. Funding flows into immersive-platform startups and enterprise metaverse projects, as reported in Crunchbase and Forbes, which points to commercial demand beyond novelty experiences. The role's quirk comes from treating space as code: doorways, soundscapes, and privacy zones are engineered like APIs. Monetization pathways include design-as-a-service, licensing, and platform revenue sharing. Statista tracks AR/VR market growth, and venture activity shows companies building the infrastructure. While large platform aggregation could create a billion-dollar opportunity for the ecosystem that includes architects, directly attributing a single occupational class alone to that scale requires careful qualification. The evidence paints architectural talent as essential to larger, fast-growing markets.

8. Bonus 1 — Seaweed Farming Commercialists (Wildcard)

Seaweed moves from coastal curiosity to sizable commodity when used at scale for food, animal feed, and carbon removal. Specialists who can manage large kelp farms, design processing workflows, and negotiate supply contracts are emerging. Statista and industry reports highlight growing demand for seaweed-derived ingredients and potential uses in carbon-credit markets. The field feels whimsical—ocean gardening meets industrial agronomy—but corporations and startups are piloting large-scale farms and processing facilities. Evidence includes startup funding rounds and corporate partnerships that appear in Crunchbase, along with government aquaculture programs supporting expansion. Regulatory clarity, logistics, and commodity pricing will determine whether seaweed farming reaches billion-dollar industry status by 2026 in particular regions. Current signals are promising for regional industry clusters, though global-scale, multi-billion-dollar outcomes would require rapid scaling beyond current public projections.

9. Bonus 2 — Digital Legacy Curators (Wildcard)

People are already paying to preserve photos and heirlooms; the next frontier is curated, interactive digital legacies. Digital legacy curators help families assemble archives, create AI-driven memorials, and manage online estates. This niche blends ethics, legal know-how, storytelling, and technical integration of AI agents that can emulate conversational presence. Startups in this space are visible on Crunchbase, and press coverage highlights growing consumer interest in preserving digital identity. The role's quirk is emotional—the product is a living archive that can speak like a loved one. Monetization could come from subscription services, estate planning add-ons, and enterprise partnerships with platforms where data lives. Because the category is early-stage and culturally sensitive, predicting a billion-dollar industry by 2026 would be optimistic; however, the combination of consumer willingness to pay for legacy services and AI tools lowering production costs creates a plausible growth path that merits watching.

10. Bonus 3 — Sensor Privacy Auditors (Wildcard)

When cities and companies plaster environments with cameras, microphones, and environmental sensors, privacy risk grows. Sensor privacy auditors specialize in assessing deployments, recommending anonymization techniques, and certifying compliance with emerging privacy rules. Deloitte and McKinsey emphasize privacy and security as business-critical elements for IoT adoption, and companies increasingly hire third-party assessors for trust-building. This job feels quirky because it's a fusion of ethics consulting and hardware auditing. Demand signals include corporate procurement language, security certification pilots, and advisory services reported by consultancies. Regulatory momentum—state-level privacy laws, sector rules—would accelerate demand for independent auditors. While the niche could become highly lucrative within a decade, direct forecasts labeling it a billion-dollar industry by 2026 are limited; evidence instead shows growing professionalization and potential as embedded services within larger compliance markets.

11. Bonus 4 — Space Tourism Experience Designers (Wildcard)

Commercial spaceflights demand more than rockets; they require carefully designed human experiences for brief but intense voyages. Space tourism experience designers craft training programs, microgravity entertainment, and in-flight rituals that make trips memorable and safe. Forbes and McKinsey analyze the commercial space market and note hospitality and services as potential value centers as launch costs evolve. This work feels delightfully odd—hospitality in zero gravity—but it merges design with aerospace engineering and human factors research. Funding for space startups and deals reported in industry press show growing investor interest, but scale-up to a broad consumer market depends on costs, safety certification, and repeatable demand. Predicting a billion-dollar industry by 2026 for the experience-design niche alone would be premature. Still, as passenger flights increase, experience services could become a valuable slice of a larger space-tourism economy. Evidence: industry reports and venture activity (Forbes, McKinsey, Crunchbase) support demand signals without definitive single-niche market forecasts.

Why these quirky jobs matter — and how to watch them grow

The jobs profiled here share a simple pattern: a technical or regulatory shift opens a surprising niche where small teams or specialists create outsized value. From AI amplifying solo founders (Inc.) to robotics putting designers at the center of human–machine choreography (Forbes, Deloitte), the forces reshaping work are technological, economic, and cultural at once. In many cases, venture funding and enterprise procurement offer the clearest signals that a niche can scale—Crunchbase and PitchBook activity matters as evidence even when formal market forecasts are absent. If you want to track which of these roles edges toward a billion-dollar industry, watch three things: capital flows (VC rounds and corporate partnerships), regulatory milestones that enable or restrict scale, and clear enterprise adoption pathways where customers pay for repeatable value. For roles tied to public policy or infrastructure—drone traffic control and urban retrofits—the political timeline is often decisive. For roles driven by platform economics—virtual architects or AI-powered solopreneurs—API availability and developer tooling matter most. This list mixes solid, fast-moving categories with speculative wildcards. That mix is intentional. Some entries already sit inside large market forecasts; others are early cultural experiments backed by funding or policy signals. Together they show how curiosity, craftsmanship, and scientific know-how can yield unexpectedly large markets. Keep an eye on the cited sources—Inc., McKinsey, Deloitte, Forbes, Statista, Crunchbase, and BLS—for the clearest early warnings that a quirky job is becoming a mainstream industry.