7 Psychological Biases That Explain Every Bad Business Decision Ever Made

In the high-stakes world of business, decision-making is a critical skill, yet even the most seasoned professionals can fall prey to psychological biases that skew judgment. These biases, deeply rooted in our evolutionary past, often operate subconsciously, leading to flawed decisions that can have far-reaching consequences. Understanding these biases is crucial for anyone looking to refine their decision-making process and mitigate the risks associated with poor choices. This article explores seven key psychological biases that frequently lead to bad business decisions, offering insights into how these mental shortcuts can distort reality and impact business outcomes.

Anchoring Bias: The Weight of First Impressions

Anchoring bias occurs when individuals rely too heavily on the first piece of information they receive (the "anchor") when making decisions. In business, this can manifest in negotiations, where the initial offer sets the stage for all subsequent discussions, often leading to skewed perceptions of value. For example, if a supplier quotes a high price, all future negotiations are likely to be influenced by that initial figure, regardless of its fairness. Anchoring can also affect market analysis, where early data points unduly influence forecasts and strategic planning. Recognizing and adjusting for anchoring bias is essential for making more balanced and informed business decisions.

Confirmation Bias: The Echo Chamber Effect

Confirmation bias is the tendency to search for, interpret, and remember information that confirms one's preexisting beliefs while ignoring contradictory data. In the business context, this can lead to tunnel vision, where leaders only seek out information that supports their strategies, dismissing any evidence to the contrary. This bias can stifle innovation and lead to strategic missteps, as companies fail to adapt to changing market conditions or consumer preferences. To combat confirmation bias, businesses should encourage a culture of critical thinking and diverse perspectives, ensuring that decisions are based on a comprehensive analysis of all available information.

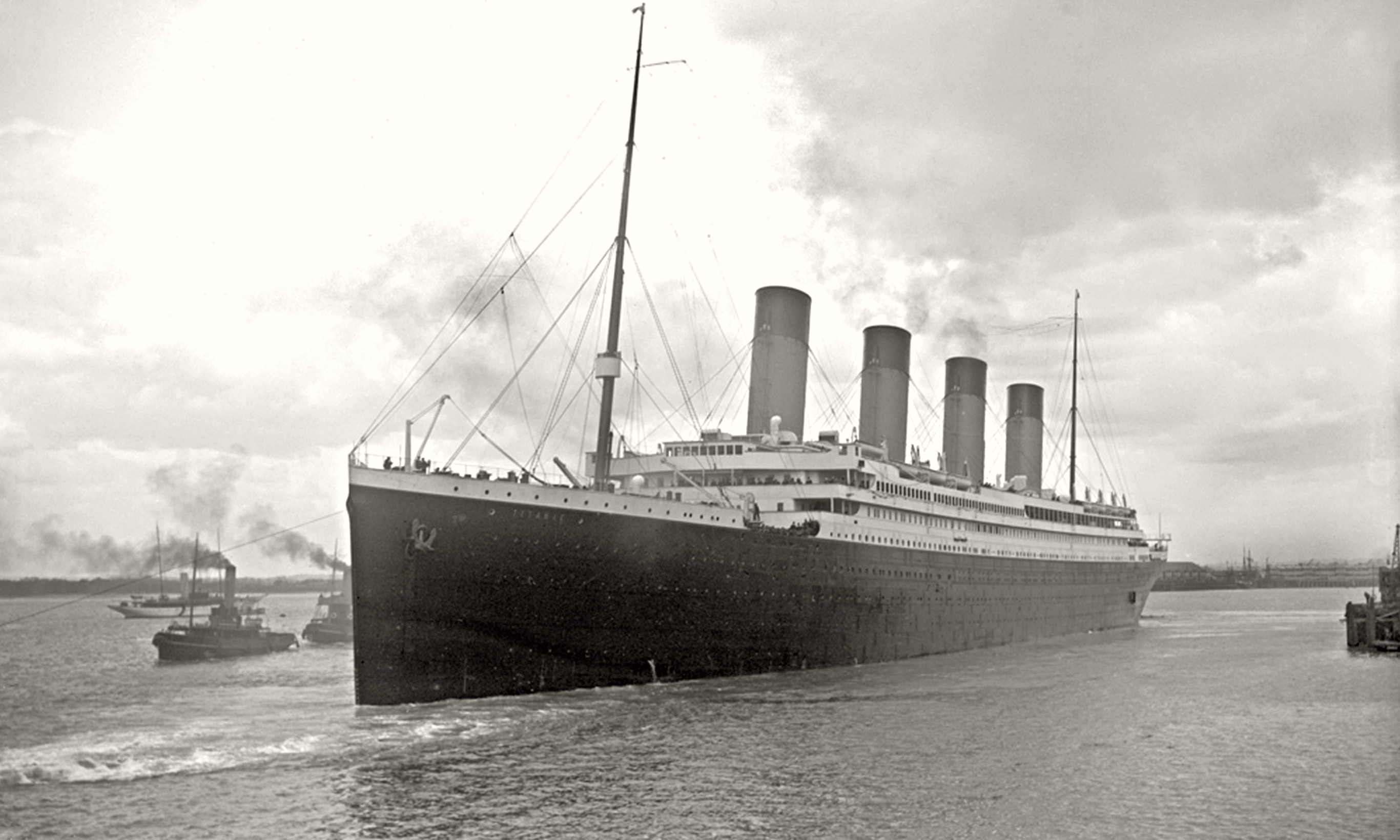

Overconfidence Bias: The Illusion of Invincibility

Overconfidence bias is characterized by an individual's unfounded belief in their own abilities, knowledge, or control over events. In business, this can lead to overly ambitious projects, underestimating risks, or ignoring potential pitfalls. Executives may overestimate their ability to predict market trends or the success of a new product, leading to costly mistakes. Overconfidence can also result in poor risk management, as leaders assume they can handle any challenge that arises. To counteract this bias, businesses should implement rigorous risk assessment processes and foster a culture where questioning assumptions is encouraged and valued.

Availability Heuristic: The Trap of Recent Events

The availability heuristic is a mental shortcut that relies on immediate examples that come to a person's mind when evaluating a specific topic or decision. In business, this can result in decisions being disproportionately influenced by recent events or easily recalled information, rather than a comprehensive analysis of all relevant data. For instance, a recent economic downturn might lead executives to become overly cautious, ignoring long-term growth opportunities. To avoid this bias, businesses should focus on data-driven decision-making processes that prioritize comprehensive historical analysis over recent, memorable events.

Loss Aversion: The Fear of Losing Out

Loss aversion refers to the tendency to prefer avoiding losses rather than acquiring equivalent gains. In business, this can lead to risk-averse behavior, where companies are more focused on preventing losses than on pursuing opportunities for growth. This bias can hinder innovation, as businesses may shy away from investing in new ventures or technologies due to the fear of potential losses. To overcome loss aversion, businesses should cultivate a culture that embraces calculated risk-taking and frames potential losses as learning opportunities, rather than failures.

Sunk Cost Fallacy: The Reluctance to Let Go

The sunk cost fallacy occurs when individuals continue investing in a decision based on the cumulative prior investment (time, money, resources) rather than future potential gains. In business, this can lead to the continuation of failing projects, as decision-makers are reluctant to abandon investments they have already made. This fallacy can drain resources and stifle innovation, as businesses become trapped in a cycle of throwing good money after bad. To combat the sunk cost fallacy, businesses should focus on forward-looking analysis and be willing to cut losses when necessary, reallocating resources to more promising opportunities.

Groupthink: The Perils of Consensus

Groupthink is a psychological phenomenon that occurs within a group of people, where the desire for harmony or conformity results in an irrational or dysfunctional decision-making outcome. In business, groupthink can lead to poor decisions as dissenting opinions are suppressed, and critical evaluation is overlooked in favor of consensus. This can result in strategic blunders, as teams fail to explore alternative options or identify potential risks. To prevent groupthink, businesses should encourage open dialogue, diverse viewpoints, and independent thinking within teams, ensuring that all voices are heard and considered before making decisions.

Navigating the Bias Minefield

Understanding and mitigating psychological biases is essential for effective business decision-making. By recognizing the subtle ways these biases can influence judgment, business leaders can take proactive steps to counteract their effects. This involves fostering a culture of critical thinking, encouraging diverse perspectives, and implementing robust decision-making processes that prioritize data and objective analysis. By doing so, businesses can enhance their strategic acumen, reduce the likelihood of costly mistakes, and position themselves for long-term success in an increasingly complex and competitive marketplace.