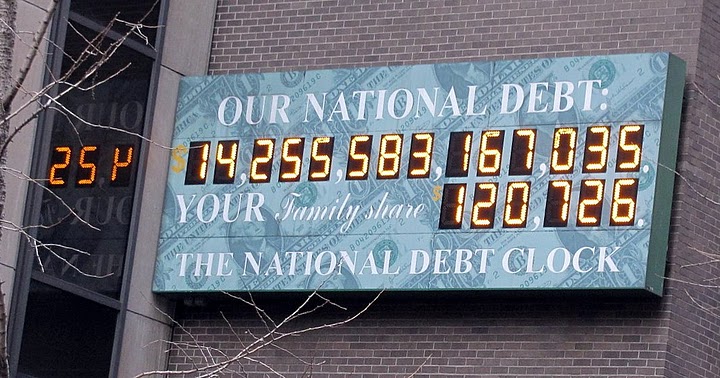

Consolidating Debt Into Easy Monthly Payments

Debt consolidation is any method of combing multiple debts into one monthly payment. There are several types of debt consolidation programs, and the goal of each is to reduce the interest rate and lower the monthly payment so you can pay off the debts in 3-5 years.

How To Consolidate Debt

First, you will want to decide which debt consolidation strategy you are going to use. As mentioned above, debts can be consolidated with or without a loan. You can find debt consolidation loans from banks and online lenders. Nonprofit credit counselling agencies will be able to provide all of the benefits of a debt consolidation loan without having to take out new credit.

There are three major benefits of debt consolidation:

A single monthly payment

It can be hard to keep up with several debts that have several different due dates and several different minimum payments. Consolidation simplifies the process with one easy payment.

Lower interest rate

Paying off debt can feel like trying to hit a moving target. You make a payment one day, and the interest shoots the balance up the next. Lowering the interest rate will limit that damage, allowing you to make more substantial dents in your debt.

Pay off debts faster

It takes about 20 years to pay off credit card debt by making the minimum payment. Debt consolidation will eliminate your debt in 3-5 years.

Which Debts Can Be Consolidated?

Debt management plans primarily consolidate credit card debt, which happens to be the most common reason to consolidate debt. But you can also add past due utilities, collection accounts, payday loans and medical debt for “payment convenience.” In other words, there isn’t a reduction in interest rates, but it can simplify and consolidate your bills.